Will Adani Go The Ambani Way?

NDTV’s share prices take a dip and then ride the crest. Is a takeover imminent?

The alleged buyout of NDTV by the Adani group has again become the hottest tittle-tattle in Indian media circles. Rumours of the Gujarat-based corporation investing in the media group first surfaced sometime in May, soon after acche din arrived along with Narendra Modi. Talks about the “imminent” deal are again gathering steam.

Support Independent Media

The media must be free and fair, uninfluenced by corporate or state interests. That's why you, the public, need to pay to keep news free.

ContributeWhile NDTV Chief Executive Officer Vikram Chandra refused to comment on a query on the issue — Chandra said he never comments on speculations — a look at the company’s shareprices variation over the last three months throws up some very interesting revelations.

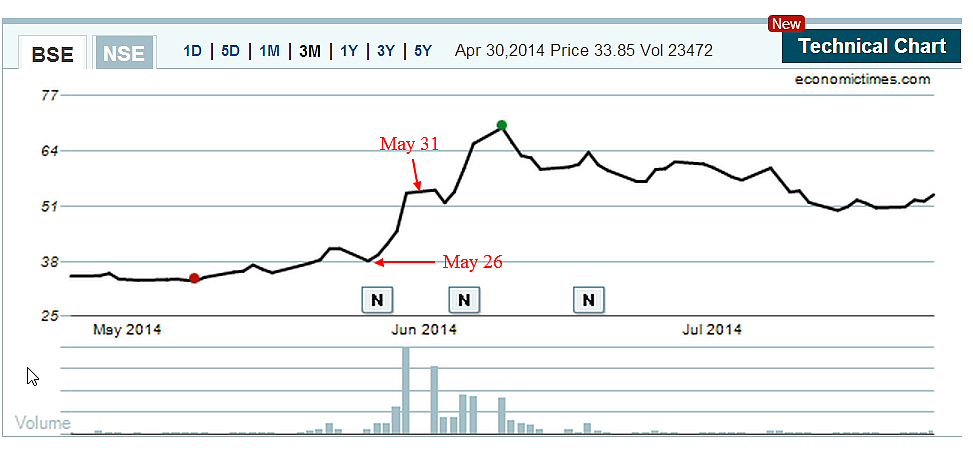

The above chart that tracks share prices from May 1 to July 24 reflects volatility. On May 16 (yes, that day when we got a new Prime Minister), NDTV’s share prices hit a low of Rs 66.25 apiece – the lowest in the last one year- following a steady decline over the weeks before that. Which is hardly surprising considering NDTV is not known to be Narendra Modi’s favourite news channel.

However, NDTV’s share prices seem to have made a rather dramatic recovery since then. On May 26, a share was worth Rs 82.95 – a 25 per cent increase since May 16 – before peaking at Rs 89.05 on June 6.

Incidentally, the buzz about Adani investing in NDTV first floated around the same time but surprisingly didn’t make it to Twitter – which happened only yesterday when Sucheta Dalal sent out these three tweets.

The latest dramatic movement in NDTV’s shares happened yesterday when the shares jumped from Rs 73.05 to Rs 87.65 in one day – an almost 20 per cent rise. The grapevine suggests that this particular spurt was fuelled by a leak that the deal was going to finally come through after much negotiation. It is also learnt that Prannoy Roy and Radhika Roy – who own around 62 percent of NDTV between them and Radhika Roy Prannoy Roy Private Limited – were on holiday flew back to Delhi yesterday. A source inside NDTV said an “important announcement” by the Roys was on the cards. Which, of course, could pertain to anything.

One could argue that the latest spike was on account of Telecom Regulatory Authority of India (TRAI) proposing a broadcaster–friendly norm yesterday. It is noteworthy, however, that NDTV’s market competitors (and other beneficiaries of the TRAI recommendation) did not register even one-fourth of the spike NDTV did in terms of its share values. TV Today’s shares went up by 5.54 per cent and Zee Media Corporation’s by 5.52 percent, as opposed to NDTV’s 19.94 per cent.

For the record, this is how Network 18’s share prices fluctuated over the last three months.

Days before the official announcement (around May 26) of the buyout by Reliance, as the word spread in the market, Network 18’s share prices took an upward swing. Déjà vu?

All charts courtesy economictimes.com

Power NL-TNM Election Fund

General elections are around the corner, and Newslaundry and The News Minute have ambitious plans together to focus on the issues that really matter to the voter. From political funding to battleground states, media coverage to 10 years of Modi, choose a project you would like to support and power our journalism.

Ground reportage is central to public interest journalism. Only readers like you can make it possible. Will you?