‘Top 1 percent will be affected by wealth redistribution’: Economist and prof R Ramakumar

India previously had wealth and death taxes from 1951 to 1986.

Wealth distribution and inheritance tax have become the talking points in the ongoing Lok Sabha election. Following statements made by Congress leaders Rahul Gandhi and Sam Pitroda, Prime Minister Narendra Modi and the BJP have warned of “wealth confiscation” by the Congress if it comes to power in the Centre.

India previously had wealth and death taxes from 1951 to 1986, aimed at curbing wealth concentration. Many argue that such taxes result in equitable resource allocation and ease the overall burden on citizens due to tax high payments to the government.

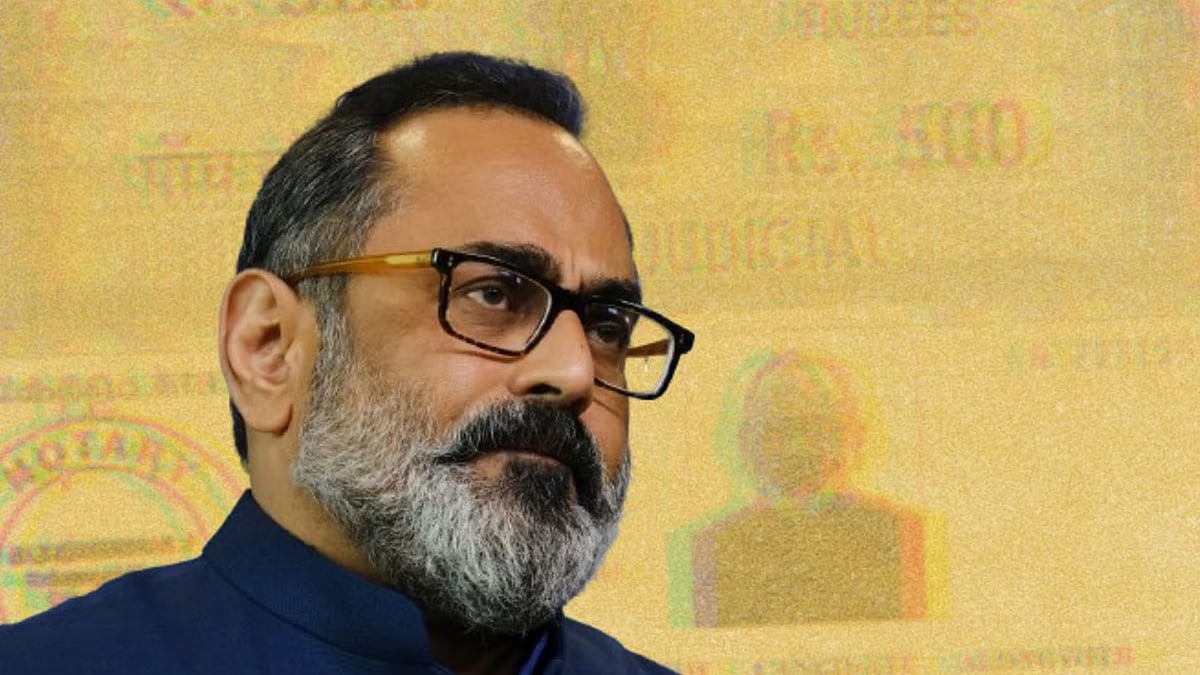

In this interview, The New Minute’s Pooja Prasanna speaks to economist and professor R Ramakumar on wealth redistribution and inheritance tax. He says “fear-mongering” by the BJP has hindered nuanced discussions and that it’s vital to assess these measures objectively, considering their capacity to address socioeconomic disparities.

Watch.

Fact check: Did Siddaramaiah include Muslims in the OBC reservation list?

Fact check: Did Siddaramaiah include Muslims in the OBC reservation list? Rajeev Chandrasekhar’s affidavits: The riddle of wealth disclosure

Rajeev Chandrasekhar’s affidavits: The riddle of wealth disclosure Is population jihad fact or fiction? Watch this 3-minute fact-check by Sreenivasan Jain

Is population jihad fact or fiction? Watch this 3-minute fact-check by Sreenivasan Jain Explained: Can wealth tax plug India’s income inequality?

Explained: Can wealth tax plug India’s income inequality?