What’s happening with your tax money?

Heard of devolution of taxes? Let us explain, with a little help from Ram, Sita, Laxman and coffee

Taxes: A chunk of money that disappears from your bank account and goes into the deep dark void.

A layperson like you and me understands taxes in the simplest of terms:

- The government takes money from you, directly as income tax and indirectly as taxes on goods and services

- This money is used to give you things like roads, railways, parks, hi-tech cameras in Parliament to capture all the action (COMING SOON IN 3D!), schemes like National Rural Guarantee Employment Scheme, put out mahussive ads in newspapers and pepper our television and web experience with cheesy Swacch Bharat Abhiyan advertisements. Like this one:

But where exactly does our tax money go? How is it spent by the government and where? Do I really have any say on what the money is being spent on? Is my money going to the Central Government in Delhi or my own State Government?How is my State Government spending that money?

The answers to each and every one of these is complicated. If you file income tax, you would know how goddamn convoluted the process is. You have to hire financial experts even to GIVE money to the government, let alone understand where it is being spent.

I know, tax days make you feel like:

In this post, I will try to answer the last two questions. How your tax money flows from up top in Delhi (Centre), to your State Government, aka: Tax Devolution. And I will try to elaborate how the behaviour of your state government is changing because of it.

Your money and Swacch Bharat Abhiyan

The Swacch Bharat Abhiyan, a scheme that primarily deals with sanitation and making India open defecation free, was launched in October 2014. Back then, it was targeted towards corporates because the government was expecting them to fund the scheme from their Corporate Social Responsibility (CSR) funds. Remember Anil Bhai Ambani going broom crazy?

Turns out, the corporates didn’t really contribute much because, you know, corporates ( ͡° ͜ʖ ͡°). The Government needed Rs 2.23 lakh crore by got only Rs 6,337 crore (less that one per cent!) in 2014-15.

Looking at the sad response from rich-people-who-own-big-companies-and-like-photo-ops, the government decided to launch the Swachh Bharat Cess in November last year: 0.5 per cent tax is charged on all services that you spend money on. But is your money really going for Swacch Bharat purposes?

Maybe. Maybe not.

Here’s the catch: according to a FAQ put out by the Government, the cess may or may not be used for the purpose of funding the scheme.

Technically, once the tax money goes to Consolidated Fund of India, it can be used for pretty much anything. All the government has to do is notify it in the Gazette and put that notification in Parliament. Hardly anyone bothers to look at these notifications because they put in hundreds of them at a time.

Things like these make the “where is my tax money being spent” situation a little confusing, to put it mildly.

Unless you go deep into the annual budget and see allocations to every ministry, and then to every department, and then to every related scheme where it is being spent, you will not really know where your tax money is going.

But, taking a broad zoomed-out view, I shall try to tell you how your tax money is being sent to your state government.

42 per cent devolution of funds

The state governments primarily depend on the Centre to give them money to running their governments. Sure, they have their own local taxes, but those barely cover the massive expenses that a state has to bear.

The Centre has done one very interesting thing recently. It’s started to give more money to the state governments from its own coffers. You must have heard this sentence being thrown around a lot: “The Government has increased devolution of funds for state from 32 per cent to 42 per cent.”

This was done according to a recommendation that was made by the 14th Finance Commission and it’s the biggest ever increase in devolution. EVER.

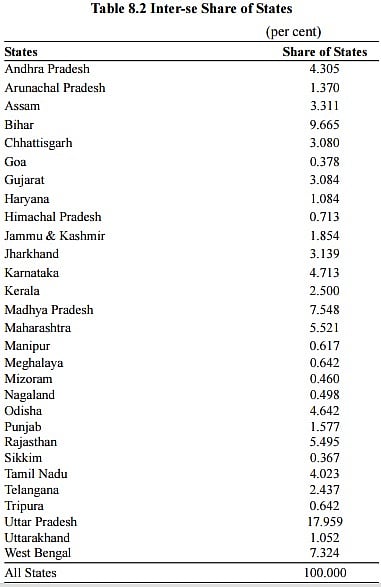

The Finance commission also decided how much of that 42 per cent will go to each state according to a set formula. Bihar, for example, gets close to 10 per cent of that 42 per cent. Uttar Pradesh gets approximately 18 per cent. These percentages are decided according to the population of the state, land-area, forest cover etc, which means the higher the population, the bigger the state, and the more money it gets.

Here is a list of how much percent of the devolution tax each state receives:

(Source: 14th Finance Commission report)

To put it simply, if the Centre gets Rs 100 in taxes, it will give Rs 42 to states. Out of this Rs 42, Rs 4 will go to Bihar and UP will get Rs 7.5, according to the formula above.

Although the Centre has increased devolution, they have reduced central assistance given to specific schemes.

Conditional vs Unconditional

Apart from the devolution money, all states also receive assistance from the Centre to run specific schemes. Schemes like Mahatma Gandhi Rural Employment Guarantee Scheme (MGNREGS) are funded by the Central government. But there are schemes like Swacch Bharat Abhiyan that are funded by both Centre and State according to a set ratio. The money that the state governments receive for specific schemes has to be spent on those schemes (conditional), while devolved money can be spent in the way they see fit (unconditional).

After the present government was formed and took over in May 2014, the Centrally Sponsored Schemes (CSS) were reduced from 72 to 27. In addition to that, there were previous schemes that were fully funded by the Centre, but now will be funded only 50 per cent. The remaining half will be covered by the State.

Net result: State governments are getting more money as devolution, but they’re also getting less money to run their schemes. It’s like taking money out of one pocket and sewing the other one up so.

Here’s a super simple back-of-the-hand comparison of the past two years.

| Year | Unconditional Funds (in Rs lakh crore) | Conditional Funds (in Rs lakh crore) | Total |

| 2016 | 5.2 | 1.9 | 7.1 |

| 2015 | 3.8 | 3.3 | 7.1 |

| Difference | 1.4 | -1.4 | ( ͡° ͜ʖ ͡°) |

As you can see, it’s a zero sum game. Conditional funds, which were earlier meant to fund schemes, are now being redirected and given as unconditional funds.

Still with me? Because it gets better.

This simple change in Centre-State funding is changing the behaviour of state governments.

Addicted to Coffee/Schemes

Example time!

Ram & Laxman both regularly get money from Sita.

Sita gives money to Ram and says, “You will only buy coffee from the money I’m giving you, dear husband!”

She is a little more indulgent of her brother-in-law, so when she gives money to Laxman she says, “Lucky, you can spend this money in whatever way you want. <3”

It’s all good for a while. Ram is having coffee regularly while Laxman chooses to hydrate himself with fizzy drinks, tea and whatever else he chooses. Then Sita decides to try something else.

Something different. Something disruptive. Something that will result in a massive behavioural change.

Sita goes to Laxman and says, “Yo Lucky, listen, take your money and Ram’s money too. From now onwards, you are going to buy Ram’s coffee and give it to him. I’m tired of giving you two money separately.”

Now it’s up to Laxman to buy Ram’s coffee. Ram comes to him and asks for it.

Laxman says, “Umm no. Coffee is unhealthy, dear brother. From now on, you drink only apple juice. No coffee for you!”

Ram, predictably, is not happy to be decaffeinated, that too so abruptly, so he says, “I need my coffee! I like my coffee! Gimme coffee!”

Lucky be like:

Now here’s the problem, Ram is kinda addicted to coffee by now. It drives him nuts when he doesn’t get his daily dose (don’t we all?). Laxman might argue that apple juice is healthier, but it doesn’t help Ram.

Sure, you could argue Ram’s headache is temporary and will go away. That apple juice *is healthier* after all. But I’m sure Ram will not be amusied.

Much like the coffee money from Sita, funds are given to state governments for schemes which the poor depend on, like the mid-day meal scheme. The scheme is supposed to encourage kids to go to school so that their parents won’t have to worry about their lunch. If one day, the scheme suddenly stops, the effect of that will be catastrophic. It might get replaced by some new scheme, a better scheme (hopefully) or it might not. It all depends on Laxman, who is getting the unconditional funds he used to get initially and, henceforth, even Ram’s share.

Moral of the Story: The money being transferred from Sita to the boyz remains constant. But when the purpose changes, so does the behaviour of the boyz.

Is this a Good thing or a Bad thing?

Well, yes and no. Maybe. Perhaps. It’s a complicated subject with many nuanced answers. This change happened very recently, so we are barely starting to see the effect on the ground. Wait and watch.

Besides, I’m not CNN.

I will leave you with one word to think about though: Decentralisation.