At Yes Bank, insiders moved on, outsiders got stuck

The insiders knew that the bank wasn’t in good shape as is clear from the fall in deposits between September and December 2019.

After a considerable delay, the results of Yes Bank for the period October to December 2019 were declared late last week. And they don’t make for a good reading.

Let’s look at this pointwise.

1) The bad loans rate of Yes Bank as of September 30, 2019 was at 7.39 percent. Bad loans are largely loans which haven’t been repaid for a period of 90 days or more. This meant that out of every Rs 10,000 loaned by Yes Bank, Rs 739 hadn’t been repaid.

The bad loans rate as of December 31, 2019 had jumped to 18.87 percent. This means that for every Rs 10,000 loaned by Yes Bank, Rs 1,887 haven’t been repaid. Or to put it in simpler terms, a little under a fifth of the loan book of the bank has gone bad. Now compare this to December 2018, when the bad loans rate of the bank was 2.10 percent.

Hence, the bad loans rate has gone up majorly between December 2018 and December 2019. Of this, the bulk of the jump happened between September 30, 2019 and December 31, 2019.

What does this mean? Did the condition of the bank deteriorate so badly in a period of just three months? Most likely not. What this basically means is that the bank wasn’t declaring its numbers properly. This raises questions regarding the ethics of the bank and its auditor. It also suggests that the banking regulator, the Reserve Bank of India, was sleeping at the wheel.

2) As of December 2019, the total bad loans of the bank stood at Rs 40,709 crore. Of this Rs 39,501 crore, or 97 percent of the bad loans, came from corporate defaults. Take a look at Table 1, which plots the segmental bad loans or gross non-performing assets of the bank.

Table 1: Bad loans breakdown of Yes Bank

Table 1 makes it clear that the bank had majorly undeclared corporate bad loans, which it corrected for in its latest results. What this also means is that the bank now needs to seriously figure out how much of these bad loans are recoverable, given that these loans would have been given against some assets.

3) Take a look at Figure 1, which basically plots the total deposits of Yes Bank. Figure 1 clearly shows us that between September 30, 2019 and December 31, 2019, the fixed deposits of the bank fell by Rs 43,742 crore, or nearly 21 percent, to Rs 1,65,755 crore.

Figure 1: Total deposits of Yes Bank

In fact, even between June 30, 2019 and September 30, 2019, the fixed deposits of the bank had come down by Rs 16,405 crore or around 7.3 percent to Rs 2,09,497 crore.

What does this mean? In the book Manias, Panics and Crashes, the economic historian Charles Kindleberger talks about two kinds of investors, the insiders and the outsiders. The insiders are the ones who are part of the financial system and in the know of things. The outsiders, well, are the outsiders.

How does this apply in the context of Yes Bank? The fall in deposits tells us that the insiders had known for a while that the bank wasn’t in good shape. This is clear from the fact that the deposits of the bank remained largely flat between September 2018 and June 2019, and then started to fall. In fact, with a nearly 21 percent fall in deposits between September 2019 and December 2019, it is clear that a section of the depositors (largely the insiders) knew that the bank wasn't in good shape and withdrew their deposits.

Meanwhile, as the bank went from bad to worse, the outsiders ended up getting locked in because of the moratorium. Who said the world is a fair place?

4) What does all this tell us? A large number of people follow the fill it, shut it, forget it strategy while depositing their money in a bank. The assumption is that now that I have deposited my money in a bank, it is bound to be safe. The bank is not the stock market. Well, it’s not, but it’s a business nonetheless. It takes money from one set of people and firms and lends it to another set of people and firms. If people and firms (firms in case of Yes Bank) don’t repay what has been lent, it should become difficult for a bank to repay its deposits.

Of course, banks don’t go bust in this day and age, and that sort of encourages people to be lackadaisical about their bank deposits. This is precisely what has happened in the case of Yes Bank as well. The insiders have moved on while the outsiders are stuck, for no fault of theirs.

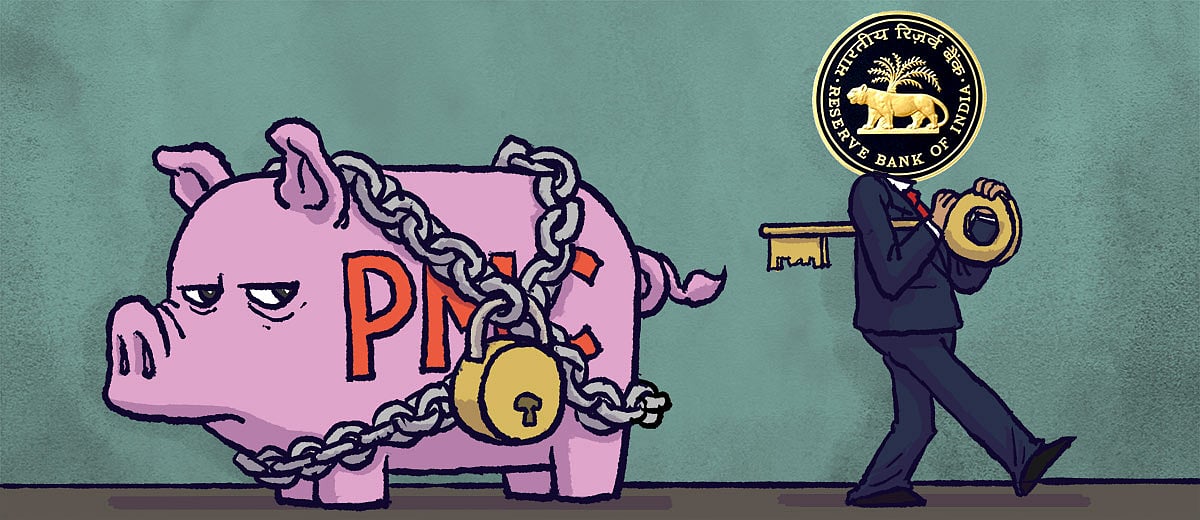

So, what does this tell us? At the cost of repetition, it makes tremendous sense to split one’s savings across banks. This is to ensure that if one bank is put under moratorium (like Yes Bank or the PMC Bank, which continues to be under a moratorium), you still have access to the bulk of your savings. The oldest and the most important cliché in investing is don’t put all your eggs in one basket. In situations like these, the importance of this cliché really comes to the forefront.

Also, in this day and age, it makes sense to keep track of news regarding the bank you have deposited your money in.

Finally, what should depositors do once the moratorium on Yes Bank ends? It clearly makes sense to move your deposits to another bank. And be quick about it.

The six unseen effects of the Yes Bank fiasco

The six unseen effects of the Yes Bank fiasco

Have money in the bank? Here’s what you can learn from the PMC Bank disaster

Have money in the bank? Here’s what you can learn from the PMC Bank disaster