Hindenburg row: ‘New material’ shows violation of rules by Adani group, says review plea in SC

The petition says the top court’s earlier judgement had multiple apparent ‘mistakes and errors’.

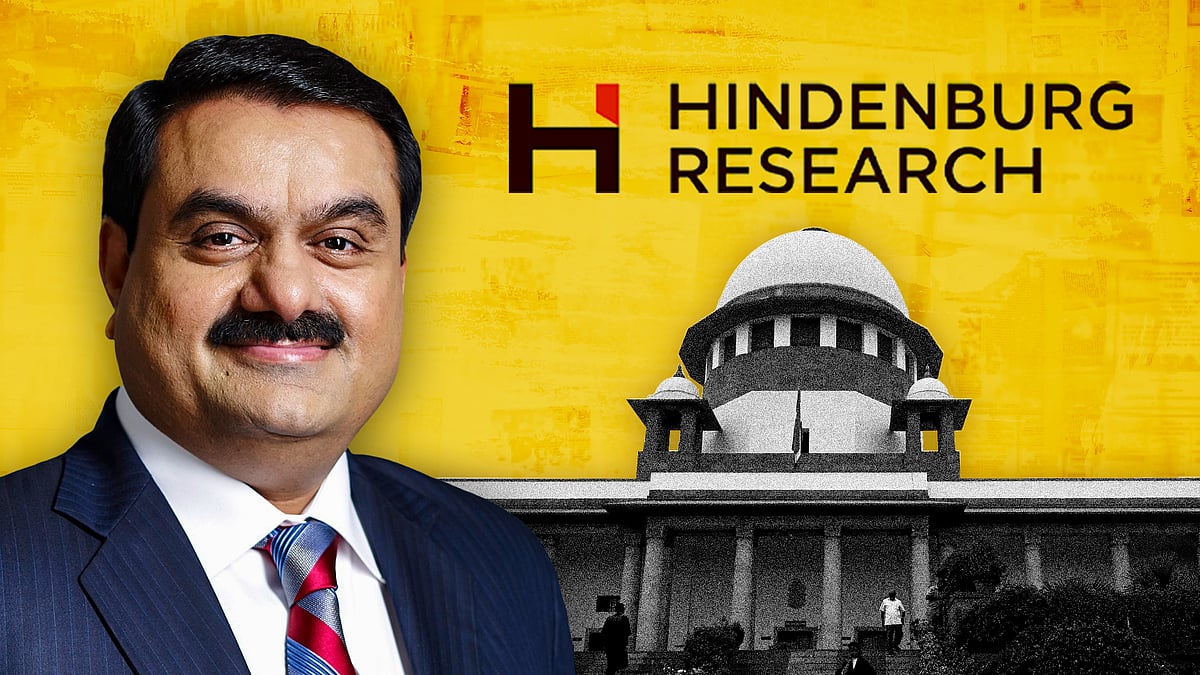

Over a month after the Supreme Court rejected petitions seeking an SIT probe into stock price manipulation allegations against the Adani group, a fresh plea at the top court has sought the review of the January 3 verdict.

Stating that investigative reports by media outlets “cannot be taken as credible evidence”, the top court had refused to interfere in the SEBI probe into the Hindenburg Research report’s allegations against the Gautam Adani-owned group.

The review petition filed by Anamika Jaiswal said the judgement had multiple apparent “mistakes and errors”. It also said that “new material” showed that the group was violating securities rules, and that there were “sufficient reasons” to review the order, Bar and Bench reported.

As per the plea, the new evidence shows that the group has been violating “Rule 19A of the Securities Contracts (Regulation) Rules (SCRR) of 1957”. The provision states that private listed companies should maintain a minimum public shareholding of 25 percent, within specified periods.

The plea said, “While the issue of over-invoicing may have not been proved, the aspect of Adani promoters investing into Adani group stocks in the Indian stock market, has never been investigated and calls for a thorough probe.” It added that unless SEBI’s findings are “publicly reported it cannot be concluded that there has been no regulatory failure”.

In January last year, Hindenburg Research, a US-based short-seller, published a damning report accusing the group of “brazen stock manipulation and accounting fraud” and pulling the “largest con in corporate history”.

In August last year, documents obtained by the Organised Crime and Corruption Reporting Project, and shared with the Guardian and the Financial Times, suggested alleged stock manipulation by four Adani companies between 2013 and 2017.

What are the allegations in the Hindenburg report all about? Watch here.

This report was published with AI assistance.

General elections are around the corner, and Newslaundry and The News Minute have ambitious plans together. Choose an election project you would like to support and power our journalism. Click here.

Adani-Hindenburg case: SC bats for institutional credibility over media, third-party claims

Adani-Hindenburg case: SC bats for institutional credibility over media, third-party claims ‘Should SEBI now follow journalists?’ SC reserves verdict in Adani-Hindenburg case

‘Should SEBI now follow journalists?’ SC reserves verdict in Adani-Hindenburg case