The backstory: Why did Mukesh Ambani’s family get Income Tax notices?

Nita Ambani and her three children were served notices under the Black Money Act in March this year.

On September 15, The Indian Express reported that the Income Tax department had served notices to “members of the Mukesh Ambani family” over alleged “undisclosed foreign income and assets”.

The report claimed that the notices were served to Nita Ambani and her three children on March 28, 2019, under the Black Money Act of 2015.

“The IT department notice has alleged that the Ambanis failed to disclose details and holdings in the Capital Investment Trust and in its ‘underlying company’, the Cayman Islands-based Infrastructure Company Limited of which they were also ultimate beneficiaries,” the report noted.

In 2011, French authorities handed over to the Indian government a list of 628 Indians who held accounts in HSBC Private Bank, the Swiss subsidiary of the world’s second largest bank, HSBC. A later investigation extended the list to include 1,195 Indian accounts. The total wealth these accounts held in 2006-07 was over ₹25,000 crore.

Subsequently, The Indian Express collaborated with the International Consortium of Investigative Journalists to investigate what came to be known as the 2015 Swiss Leaks, a tax evasion scheme operated with the knowledge of HSBC. The investigation linked Mukesh Ambani’s Reliance group to offshore entities which had deposited around $601 million in a cluster of 14 HSBC Geneva bank accounts. According to the March 2019 Income Tax notice, members of the Ambani family have been named as “ultimate beneficiaries” of one of these 14 entities, the Capital Investment Trust.

An Income Tax department document accessed by Newslaundry sheds light on how the Ambani family set up an elaborate corporate structure which enabled them to become the “ultimate beneficiaries” of the Capital Investment Trust.

***

The document, dated June 11, 2015, notes that details of the Ambani family’s offshore assets was obtained by the Indian government from British Virgin Islands, a Caribbean tax haven.

A file note on the document explains why the Ambani family needed a structure of offshore and domestic entities to begin with. The note was written by one Robert Plasses, director of the HSBC in Geneva in 2003.

“Sh Damani (Settlor) and Sh Dhirubhai Ambani were cousin brothers who had mutual business interests,” the note reads. “In the 1980s, it was agreed that the management of [the Ambani] family’s international personal investments would be under the auspices of the Settlor [Damani] in view of his residence in Dubai. Over a period of years, a number of companies were established. The ultimate holding company was National Industries.”

The note claims that after Dhirubhai Ambani’s death in 2003, the Ambani family decided to part ways with Damani. They wanted Damani to transfer their share of the assets to an impersonal trust whose ultimate beneficiary was a family-controlled company.

This impersonal trust is the Capital Investment Trust, whose beneficiaries are members of the Ambani family, as the Income Tax notice points out. Damani allegedly set out to transfer the family’s funds to this trust from National Industries, a holding company he managed.

An elaborate structure was set up to enable this transfer.

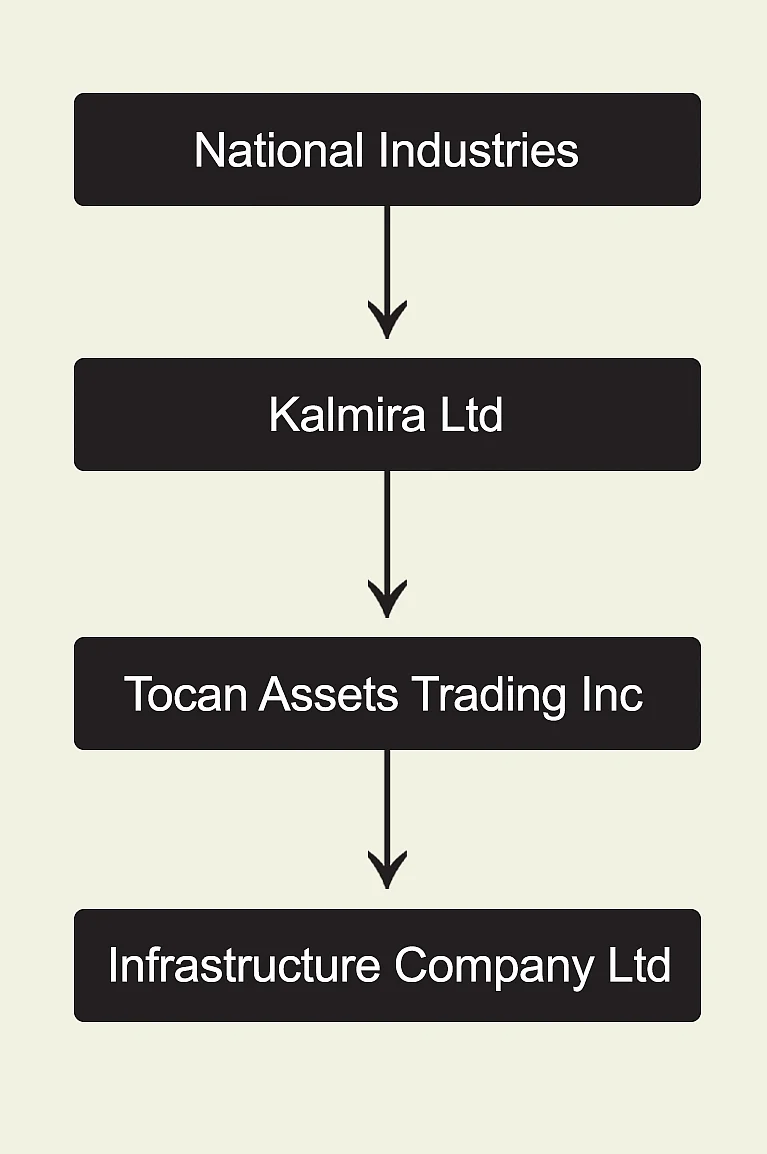

First, assets from National Industries were shifted as shares to the HSBC Geneva account of Infrastructure Company Ltd, which was listed in what was then the Netherlands Antilles in the Caribbean. The transfer was done via two other entities — Kalmira Ltd and Tocan Assets Tradings Inc.

Flow of funds.

After this transaction in February 2004, Infrastructure Company Ltd had $400 million in its HSBC account — $270 million of this belonged to Reliance Ports and Terminals Limited, and $130 million to Reliance Utilities and Power Limited.

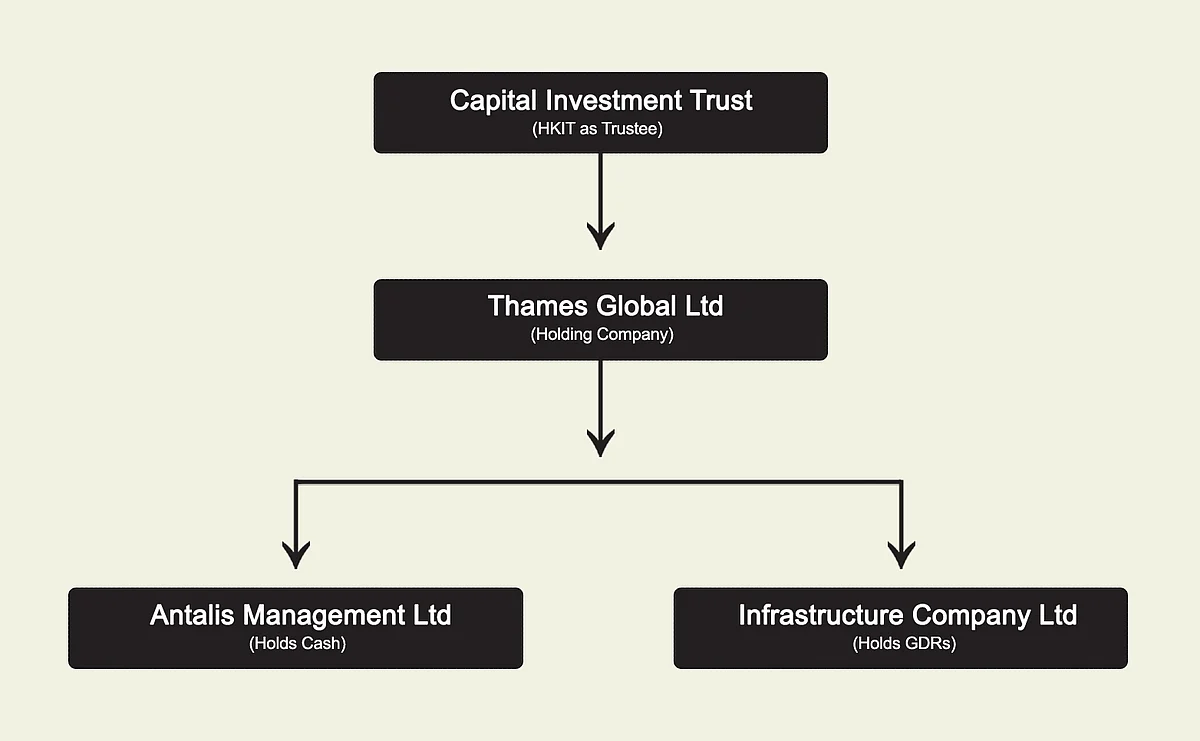

The document reveals that Infrastructure Company was owned by Thames Global, a holding company under the Capital Investment Trust, which was supposed to receive the Ambani family’s share of the assets from Damani’s National Industries.

Structure of ownership.

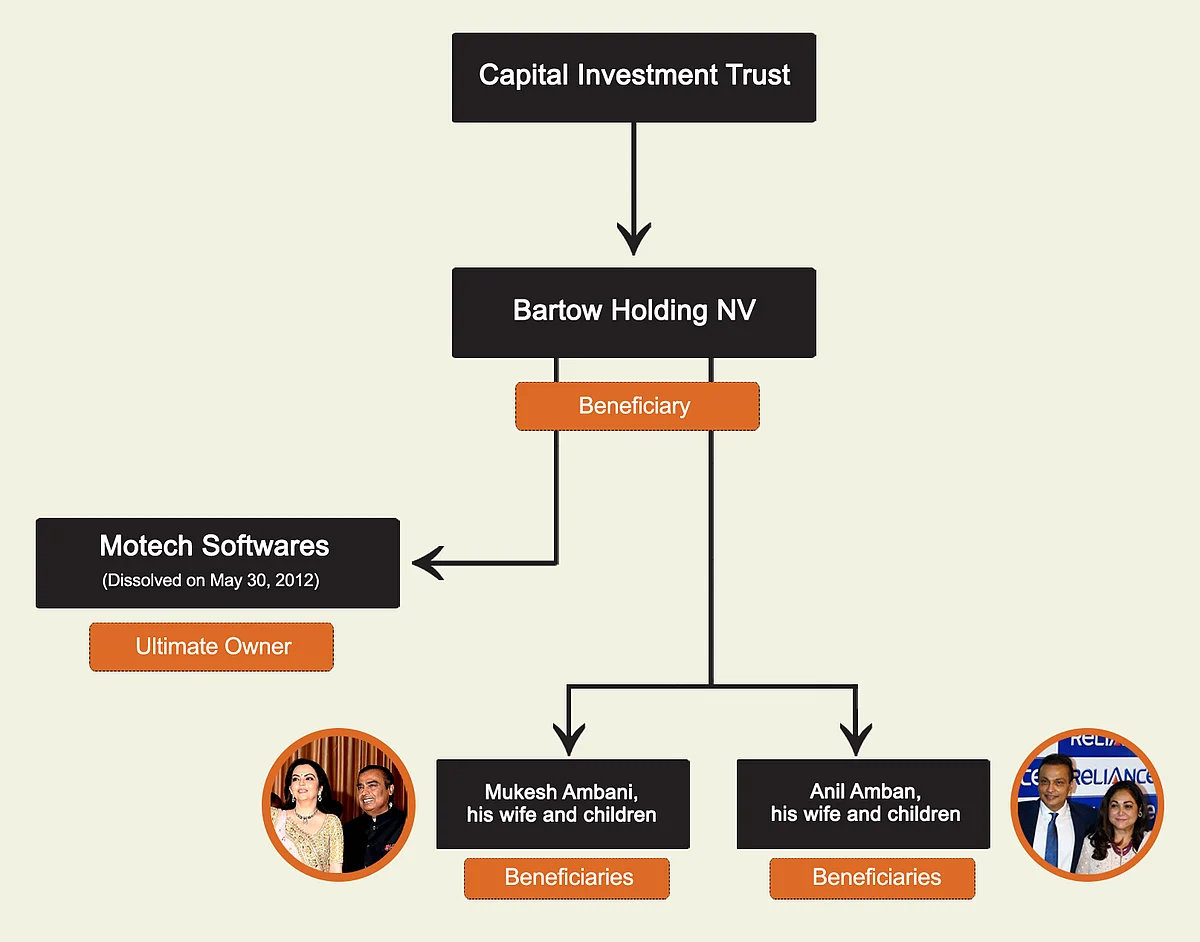

Further, the document shows that one beneficiary of the Capital Investment Trust was an entity called Bartow Holdings NV. The beneficiaries of Bartow Holdings NV, in turn, were represented by Mukesh Ambani and his brother Anil Ambani as well as their wives, Nita and Tina, the document shows.

Bartow Holdings was allegedly owned by Motech Software Pvt Ltd, based in Andheri, Mumbai.

The link between Bartow Holdings and the Ambani family was established through a certificate produced in 2003-04 by Raj Parmar, an employee of HSBC Republic Bank in London. The certificate, the Income Tax document notes, was accepted by DA Whitefield, CEO of HSBC.

The document quotes an internal note by Parmar to HSBC Republic Bank, Geneva: “I can confirm that I have shown the confidential documentation which confirms Motech Software Pvt Ltd is the ultimate owner of Bartow Holdings NV, and that the ultimate beneficial owners of Motech Software are represented by Mukesh Ambani, his wife and by Anil Ambani, his wife and issue in their personal capacities.”

Beneficiaries and owners.

According to a 2015 report in The News Minute, Motech held an account with HSBC Geneva. This account had the highest amount of money of all 1,195 Indian accounts in the Swiss bank — $467 million. Motech, which engaged in the business of software development, had an authorised capital of ₹50,000,000 in 2009.

The report claimed that three companies — Infrastructure Company Ltd, HRJ Holdings NV, Aberdeen Enterprises NV — deposited a total of $467 million into Motech’s account in 2006 and 2007. Of this, Infrastructure Company Ltd alone deposited some $400 million.

When the Income Tax department learnt of these transactions in 2015, it initiated “reassessment proceedings” against Motech for an “undisclosed income” of approximately ₹2,200 crores between 2006 and 2008.

However, the document accessed by Newslaundry alleges the directors of Motech dissolved the company as the proceedings started. This was done without informing the department and in contravention of the Companies Act.

“Suppressing/misrepresenting the material facts before RoC [Registrar of Companies] Mumbai, these Directors got Motech dissolved and struck off Registrar of Companies on 30-05-2012 i.e. before the reassessment orders were passed. RoC also failed to follow mandatory procedure while striking off,” the document states.

The Registrar of Companies under the Union Ministry of Corporate Affairs deals with the administrative aspects of the Companies Act of 1956 and the Companies Act, 2013.

In early September, there was a break-in at the office of Alka Tyagi, one of the Chief Commissioners of Income Tax in Mumbai. The incident was kept under wraps for over three weeks until The Indian Express reported about it on September 27. According to the report, Tyagi’s unit is handling several high-profile tax assessment cases like the Deepak Kochhar-ICICI Bank case and the Ambani family Black Money Act case.

Newslaundry sent a detailed questionnaire to the spokesperson of the Reliance Industries as well as to Mukesh Ambani and to Anil Ambani.

A Reliance Industries spokesperson told Newslaundry: “We deny all the allegations in your email including receipt of any such notice.”

The story will be updated if and when Mukesh Ambani and Anil Ambani respond.