Data doesn’t lie: Did Bengal economy really worsen under Mamata Banerjee?

The state managed to improve its fiscal health under Mamata’s rule though unemployment is still the subject of a raging political battle.

“At the time of independence, Bengal’s share in India’s industrial production stood at 30 percent,” home minister Amit Shah proclaimed on December 20. “Today, it has come down to a mere 3.5 percent. I want to ask Mamata Didi and the communists: who is responsible for this?”

Placing the blame squarely on the state’s successive regimes of the Congress, the Left front, and the Trinamool Congress, Shah added: “In 1960, Bengal’s per capita income was 105 percent of Maharashtra. Now, it’s not even half.”

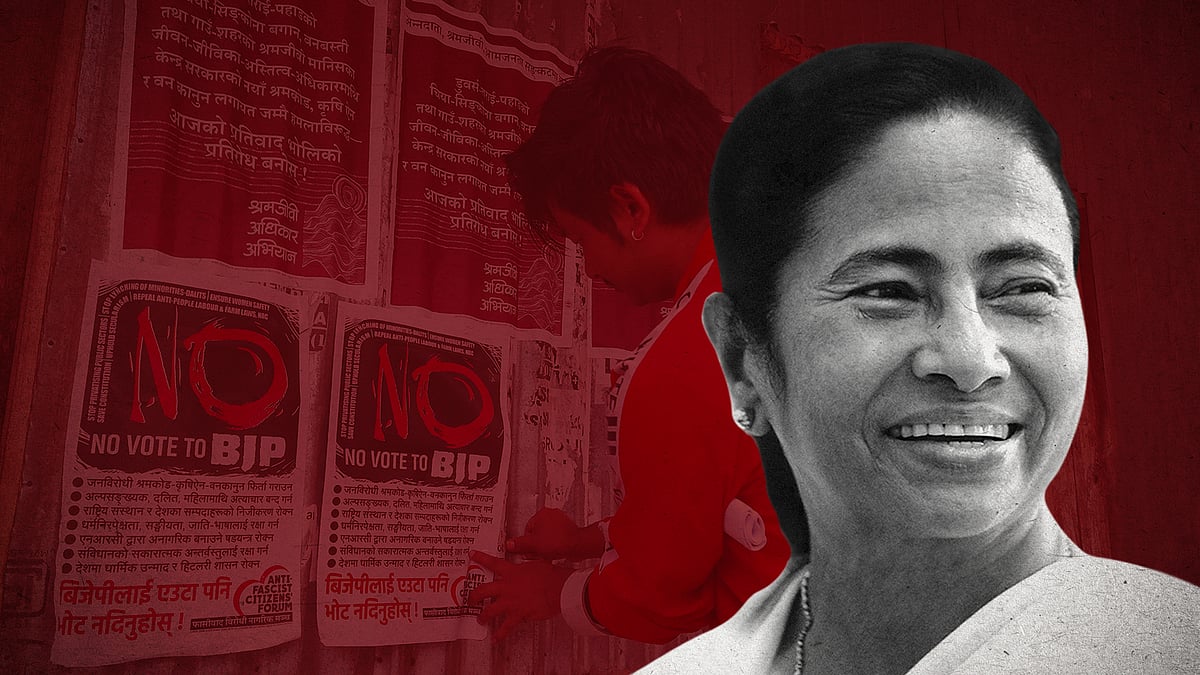

Mamata Banerjee shot back at Shah the very next day.

“Amit Shah has spoken garbage of lies yesterday,” she said. “He claimed our state is zero in industry but we are number one in the MSME sector. He claimed we could not build roads but we are number one in that. This is [based on] the government’s information.”

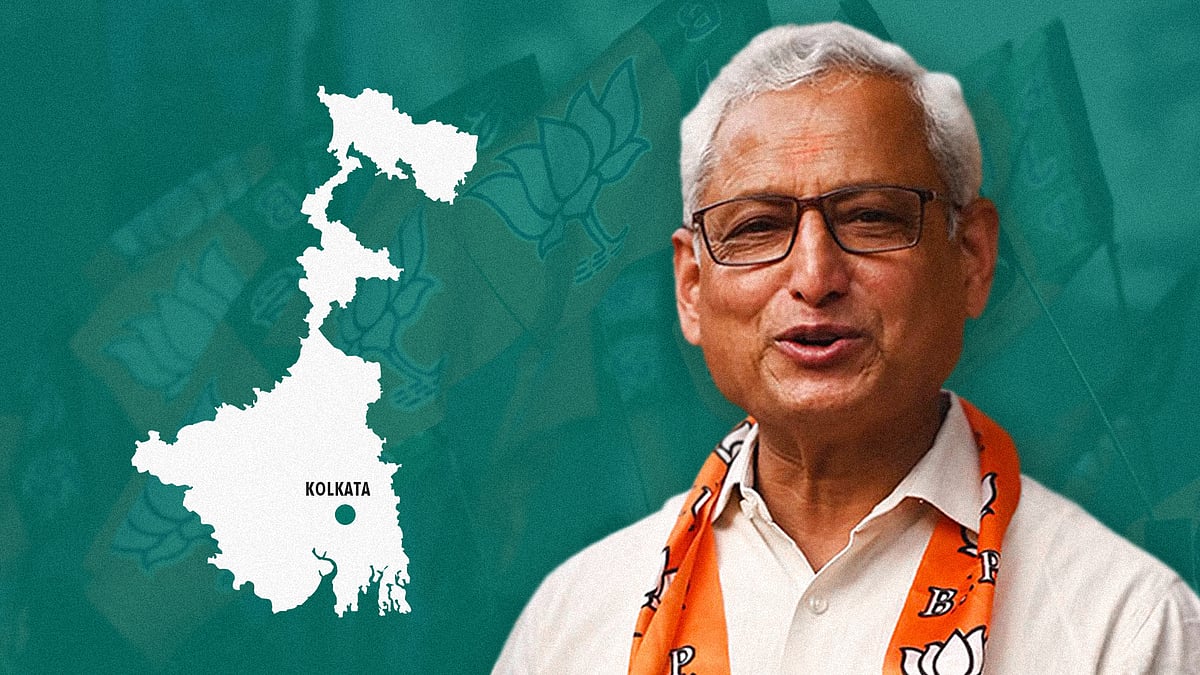

Undeterred, however, Shah and Modi’s campaign in Bengal has focused on their promise to restore the state to “Shonar Bangla”, golden Bengal. Bengal’s “reducing economic fortunes” has become a matter of intense debate ahead of and during the assembly election.

While there’s no denying that Bengal’s share in India’s industrial output has significantly declined since Independence, has the state of its economy actually improved or declined under Mamata Banerjee?

Here’s the short answer: Bengal might lag behind the national average and other major states when it comes to some fiscal indicators. But since Mamata took charge in 2011, there’s been an improvement in several key indicators.

Let’s break this down.

Economy in Mamata’s Bengal

Going by the size of the economy in terms of gross state domestic product, or GSDP, West Bengal ranked sixth among Indian states in 2011-12. Its rank remained the same in 2018-19 according to both current prices and constant (2011-12) prices.

However, while looking at the state’s biggest economic issues – high debt burden and low revenue generation – its performance has improved since 2011.

Bengal’s debt-GDSP ratio stood at its peak in 2010-11 at 41.9 percent, according to a Niti Aayog-sponsored survey conducted by IIM Calcutta. This was the highest in the country. Since then, the ratio has gradually come down and stood at 34.75 percent in 2018-19, according to the state’s budget report.

The state’s gross fiscal deficit as a percentage of the GSDP has also improved from 4.2 percent in 2010-11 and 3.4 percent in 2014-15 to 2.96 percent in 2018-19, according to the same reports. The GSDP growth rate at 2011-12 constant prices went up from 4.17 percent in 2012-13 to 6.13 percent in 2015-16, 7.2 percent in 2016-17, and 6.41 percent in 2018-19. However, it still consistently remained below the national average.

According to the ranking of states’ per capita income at current prices, as of March 8 last year, Bengal’s rank has improved from 15th in 2011-12 to 13th in 2016-17. However, going by constant prices (2011-12), its ranking has not changed.

A major reason for the state’s high debt burden has been the low collection of its own tax revenue, or OTR. The Niti Aayog-sponsored study said, “It is the nature of economic growth in West Bengal that is problematic since it is driven by the unorganised sector.” This, in turn, led to lower revenue generation as the economy was “dominated by ‘hard-to-tax’ sectors, with a vast and expanding unorganised sector”.

But there have been some signs of improvement in this regard.

During the last leg of Left front rule between 2006-07 and 2010-11, the state’s OTR to GSDP share stood between 4.22 percent and 4.59 percent which, according to this CAG report, was “lower than the target of 6.8 percent recommended by the 12th Finance Commission”. The state’s budget document shows that in 2018-19, OTR had risen to 5.36 percent of the GSDP.

Going by the budget document and this report, West Bengal’s revenue deficit as a percentage of the GSDP has improved from 3.75 percent in 2010-11 to 2.1 percent in 2014-15 and 0.92 percent in 2018-19. The state’s gross fiscal deficit as a percentage of GSDP has also improved from 4.2 percent in 2010-11 and 3.4 percent in 2014-15 to 2.96 percent in 2018-19.

A similar improvement was observed in the debt to revenue receipt ratio, which came down from 396.47 percent in 2010-11 to 269.43 percent in 2018-19. The fiscal deficit as a percentage of revenue receipt also dropped from 41.33 percent to 22.94 percent in the same period.

West Bengal seems to have performed well in prioritising the social service sectors which includes education, sports, art and culture, health and family welfare, water supply, sanitation, housing, information and broadcasting, labour and labour welfare, social welfare, nutrition, and the welfare of STs, SCs and OBCs. The share of social service sector expenditure in the state’s total expenditure increased from 9.8 percent in 2010-11 to 19.42 percent in 2018-19.

The state government also reported a rise in the share of capital expenditure as a percentage of total expenditure from 3.61 percent in 2010-11 to 12.5 percent in 2019-20.

According to this Crisil study, in 2018, fiscal deficit was smallest in Gujarat, Maharashtra and West Bengal. The study also said that the debt situation was better in 2018 than 2013 in only four states: Gujarat, Maharashtra, Uttar Pradesh and West Bengal.

In 2018, West Bengal ranked first among the states in spending in social security and welfare, second in urban development, and third in rural development and health. Analysing the state’s budget and RBI documents, the study thus ranked West Bengal’s priorities: education, rural development, social security and welfare, health, urban development, roads and bridges, irrigation and housing.

However, the state has done poorly in drawing foriegn direct investment. According to the report, West Bengal’s share in FDI inflow in the country stood at only one percent in 2019-20.

Who (or what) ailed the Bengal economy?

While Shah and Modi point fingers at the state’s previous governments for “ruining” Bengal’s economy, the data says otherwise. A 2010 report by the Planning Commission said that Bengal started to lose its industrial primacy among states since the mid 1960s, owing largely to central government policies such as reducing public sector investment by the centre, the freight equalisation scheme of 1956-1991, and the “license permit raj” from 1947 to 1991.

The report said: “Industrial growth in West Bengal, as in other constituent states in India, has largely been determined by the stance of economic policy adopted by the central government, the allocation of central public investment in industry and infrastructure, the allocation of credit by banks and term lending institutions under the control of the central government and the general attitude of large business houses and multinational corporations towards investment in that particular state.”

According to the report, while the total industrial developments in the state by the central government accounted for nearly 13 percent of the total investments sanctioned by the centre between 1947 and 1968, no significant new investments were granted for Bengal in the 1970s and 1980s.

Debraj Bhattacharya, an author and researcher in history and social sciences, noted that Bengal got a “relief from centre’s control” after the economic reforms of 1991. But by that time, the economy had suffered major losses due to issues beyond the state’s control.

“The Jyoti Basu government’s new industrial policy of 1994 was quite pro-industry and the party turned more favourable towards industrialisation during Buddhadeb Bhattacharjee’s chief ministerial rule. However, what happened in Singur in 2006 under Mamata Banerjee’s leadership was very impactful in many respects,” Bhattacharya said, mentioning that no big industry had come to Bengal since then.

Between 2006 and 2008, Mamata Banerjee-led agitations stalled two major industrial projects planned by the Left front governments: the Tata Nano car plant in Singur and Indonesia’s Salem group’s chemical hub at Nandigram.

With respect to the current TMC government, it has from the start opposed the government acquisition of land for private industrial projects and setting up special economic zones. Its focus was on micro, small and medium enterprises, or MSMEs, and reviving the rural economy. Mamata had said in 2013 that public-private partnerships were welcome but a blindfold incentive scheme for setting up industries in the state would not be allowed.

Recently, the chief minister also made it clear that she is against diluting or relaxing existing labour laws and criticised BJP-run states like Uttar Pradesh, Madhya Pradesh, Gujarat and Assam for doing so in the aftermath of the lockdown.

As Bhattacharya said, “The state has done fairly well in the MSME sector during Mamata Banerjee rule but it seems that the TMC chief has developed an image of being against big industries.”

In Rashbehari, BJP pitches for their ‘Balakot strike’ candidate to win over intellectuals

In Rashbehari, BJP pitches for their ‘Balakot strike’ candidate to win over intellectuals

Relegated to a supporting role, will the TMC catamaran sink or sail in Darjeeling?

Relegated to a supporting role, will the TMC catamaran sink or sail in Darjeeling?